How Will U.S. Tariffs Affect Leica Prices? It’s Complicated.

You’ll pay more for a new or used Leica, but the devil is in the details!

By Jason Schneider

A tariff is a tax imposed by a country on goods imported from other countries. These taxes are often used to protect domestic industries and jobs, and they can also be a source of revenue for the government. There are certainly political ramifications to formulating and executing U.S. tariff policy, but this article will try to steer clear of politics. Instead, it will be laser focused on how current and proposed U.S. tariffs are likely to affect the prices of new and used Leica products and whether there are any legal means of mitigating their effects. Starting May 1, 2025, Leica Camera USA implemented a 7% increase in suggested retail prices across most of its product line, including its highly sought-after cameras and lenses. The change was a direct result of newly imposed U.S. tariffs on imported goods, which have significantly impacted Leica’s logistics and import costs.

Why Are Leica Prices Increasing?

According to a statement by Leica, the price hike is due to U.S. trade tariffs that affect the cost of importing camera gear. Because Leica distributes all North American inventory through the U.S. before it reaches Canada, the tariff price impact extends to Canadian consumers as well. Leica’s decision to maintain price parity between the U.S. and Canada is more manageable and ensures consistent pricing across borders, but it also means Canadian customers will face the same price hikes even though the tariffs are American in origin.

How much will Leica prices ultimately increase? It’s still up in the air. The United States implemented reciprocal tariffs on most goods imported from the European Union (including Leica gear from Germany) starting with an additional 10% duty rate effective April 5, 2025, and increasing to 20% on April 9, 2025. The EU is preparing to retaliate with its own tariffs on US goods, but both parties are still negotiating a possible compromise. In addition, as of Friday May 23, a sweeping 50% tariff on all goods from the EU was scheduled to begin on June 1, 2025, but that has just been pushed back to July 9, 2025. Leica cameras made to Leica’s specs in China (such as the Leica D-Lux 8) initially saw much higher price increases due to U.S. tariffs of up to 145% on Chinese goods, but both the tariffs and the prices have been dramatically scaled back, at least for now.

Leica USA initially posted average price increase of approximately 7% across all product categories that affected the Leica M-, SL-, Q-series cameras, Leica lenses and accessories, and Limited-Edition Leica gear and kits. For example, a Leica product previously priced at $5,000 would now cost around $5,350, depending on the exact model and retailer. However, these specific figures have not been officially confirmed, and with the proposed new 50% U.S. tariffs on all EU goods, all price increase percentages could be higher going forward – and could fluctuate up or down.

Are there legal ways to avoid paying tariffs on Leica gear? Yes, but…

Buy new Leica cameras, lenses, etc. already in stock at pre-tariff prices. Items already in a dealer's inventory generally are not subject to new tariffs that go into effect later. Tariffs typically apply only to imported goods entering the country or withdrawn from storage on or after the effective date of the new tariffs.

Here are some additional details:

Tariffs are levies on goods entering the United States from another country, and they typically take effect on a specified date (e.g., April 3, 2025, for automobile tariffs). It is the importer that is responsible for paying the tariff.

There may be some exemptions for goods already in transit (e.g., loaded on a ship or truck and on their final mode of transport to the U.S. before the effective date). Goods already downstream from the importer and in the hands of a retailer are generally not subject to further tariffs. That means existing stock on an auto dealer’s lot or at a camera retailer is not subject to tariffs.

New stock coming in after tariffs are imposed could well mean the importer increases its prices and thereby passes down all or some of the tariff to the retailer, who would then pass along higher prices to the consumer.

Of course, dealers may choose to adjust their pricing as they see fit, whether to recapture their increased costs, or to simply increase profit margins to reflect the increased cost of importing new goods. The message for Leica fans is clear: Check prices carefully and then purchase items now in stock at favorable pre-tariff prices now, before they run out!

Buy used Leica cameras, lenses and other equipment

You won’t have to pay newly imposed tariffs on a used camera purchased from a US based dealer or private seller. That M3 you are looking at was imported decades ago and tariffs would not affect its price (unless as is possible, used gear rises in price in response to a general tariff-driven price rise on new gear).

Buy Leica gear at Duty-Free shops overseas or in the U.S.

You might think that buying at a Duty-Free shop (In Japan, Europe, or elsewhere) means you escape paying duties when you come home with your purchase. After all, they say “Duty Free”. But that’s not how it works. What you are avoiding are local taxes (like VAT in Europe). When you return to the US, you are the importer, and your newly purchased camera is subject to US tariffs. The difference is an individual can generally exclude $800 from the value of the imported goods (and families living together can pool their exemptions). If a tariff is payable at the current very high rates, you might save a few dollars on the VAT, but the total cost will be driven by the local exchange rates as well as tariffs and on new Leica cameras or lenses, so it’s going to be very hard to save anything compared to buying in the U.S. (The same goes for any other foreign purchase where you avoid or get a refund of VAT; you can save some money, but it probably isn’t enough to make it lower than the US price). US based duty-free shops are not a real option because they are almost always limited to outbound passengers leaving the US.

Buy new or used Leica items on eBay or other online auction sites.

Simply buying on eBay, Etsy, or other online auction sites won't guarantee you'll save on tariffs if the seller is located outside the U.S. However, eBay does offer programs to help manage international shipping and potentially includes charges and fees at checkout, but the overall cost can still be affected by tariffs.

Herewith some additional details: eBay's Global Shipping Program helps manage international shipping, including potential duties and fees. This program can include all costs upfront, eliminating surprises at delivery. But eBay doesn't directly manage tariffs — the shipping providers and customs authorities handle those. However, eBay can help manage the shipping process and may include duties and fees at checkout. In short, while eBay can help streamline the process, it's unlikely (and unable) to eliminate tariffs entirely. The cost of tariffs will still depend on the goods being purchased and the applicable rates.

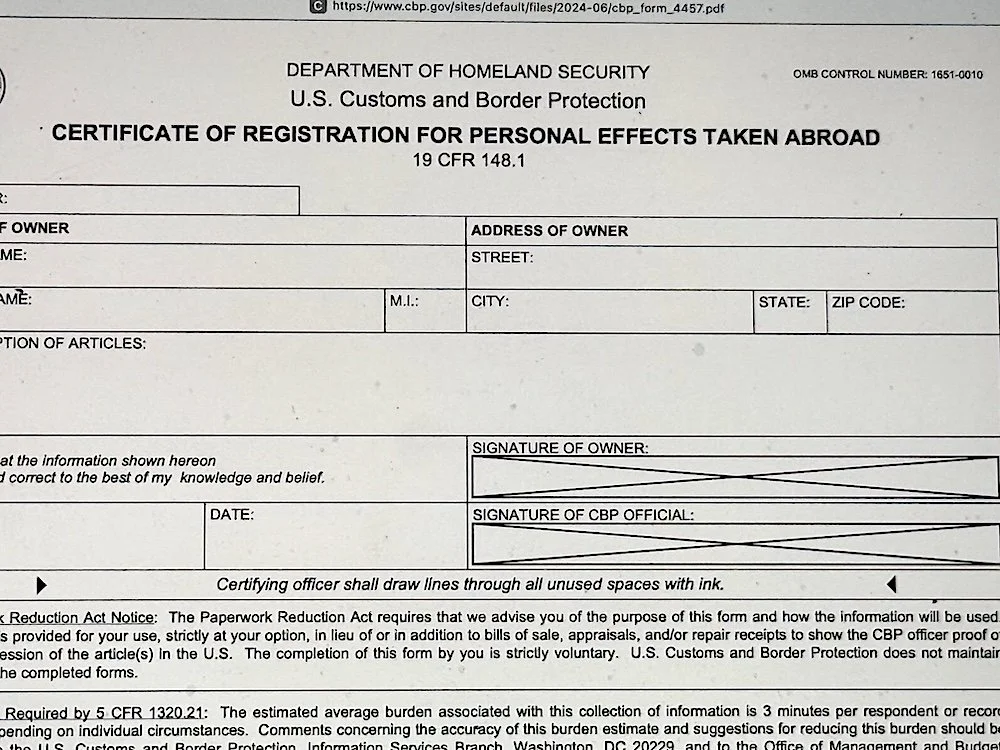

Traveling Tips—Know Before You Go

Finally, with all online purchases, be aware of shipping costs, since they can significantly impact the final price. And, be sure to register valuable equipment you’ll be taking abroad with U.S. Customs: To avoid potential issues with Customs upon your return, it's a good idea to register your equipment with U.S. Customs and Border Protection (CBP) before leaving the country. This is especially important for high-value foreign-made items like cameras, lenses, laptops or watches. You can do this by obtaining a Certificate of Registration (CBP Form 4457) at a CBP office or at an international airport. Make sure the document is signed by a CBP officer, is legibly filled out with model names and serial numbers and secured in a safe place so you can present it to the Customs Agent upon your return.

Going through U.S. Customs with new or used gear purchased abroad:

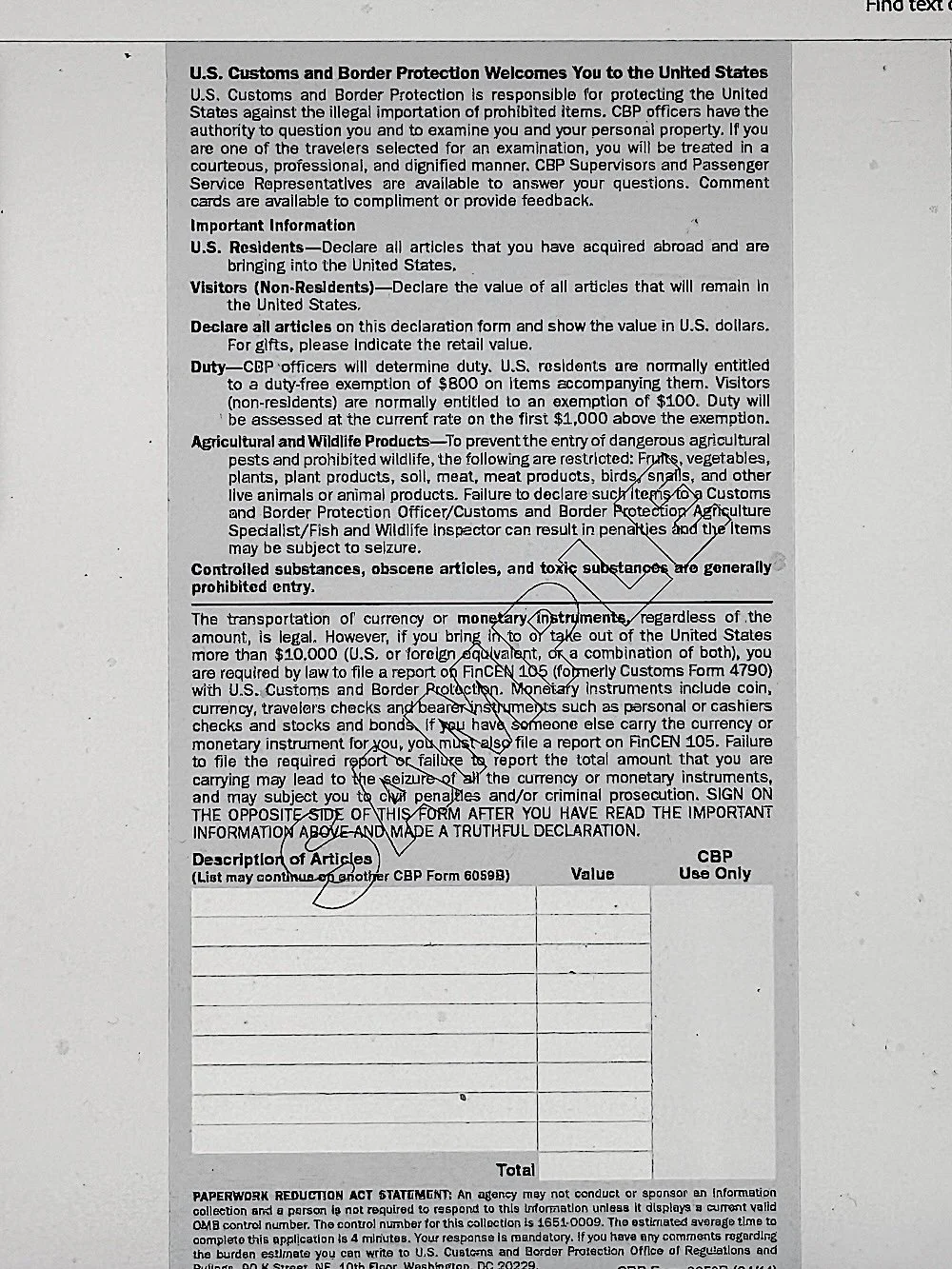

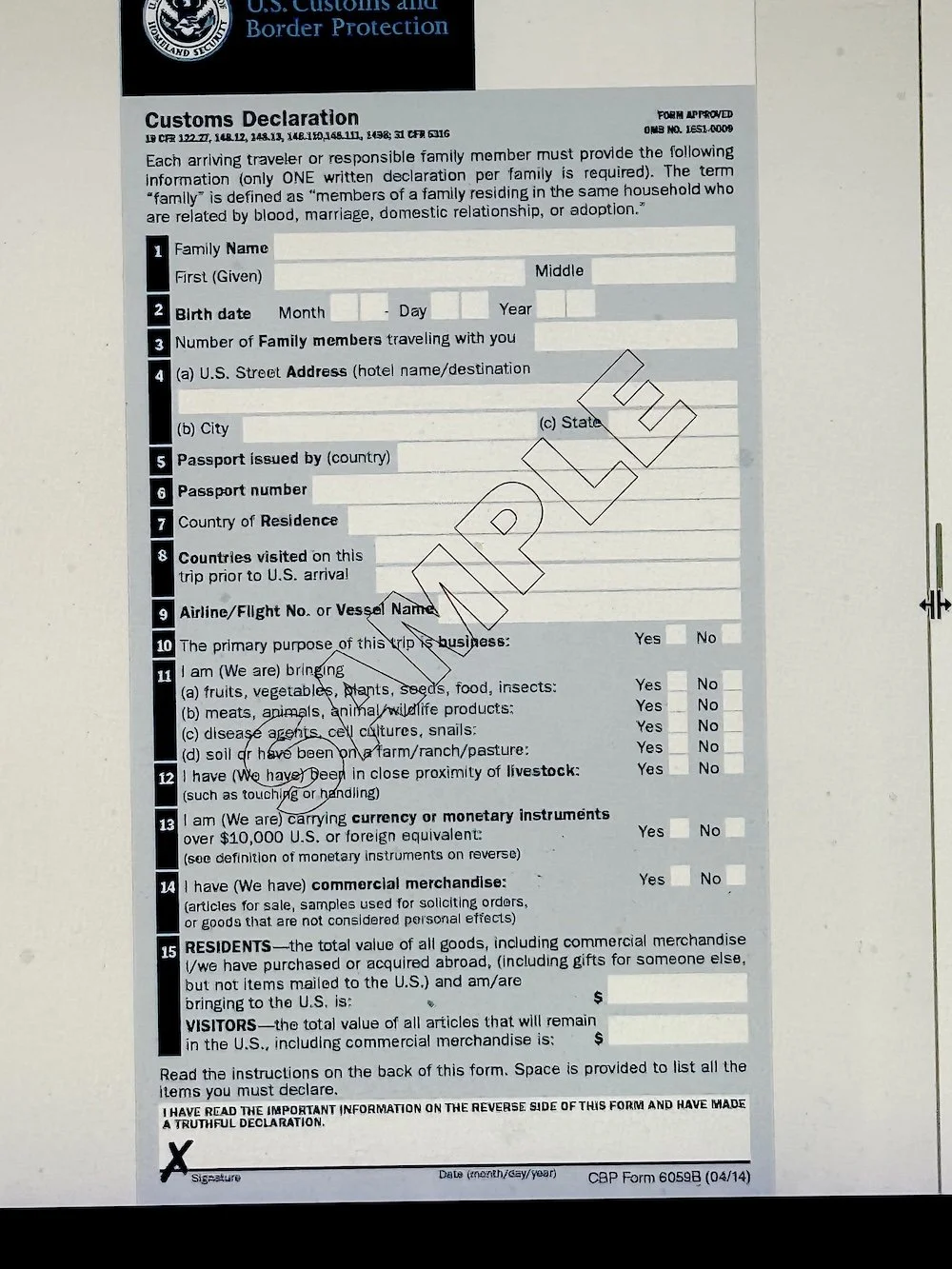

When returning to the U.S., travelers need to complete a Customs Declaration Form 6059B, which can be done online, on Global Entry kiosks, or on paper. They should also have their purchase receipts ready and be prepared to declare any merchandise (and agricultural products) acquired abroad.

Here's a detailed breakdown:

1. Complete the Customs Declaration Form: All travelers, including U.S. citizens and lawful permanent residents, must complete the CBP Declaration Form 6059B. This form is used to declare any merchandise, agricultural products, or other items acquired abroad.

2. Declare Purchases: Be prepared to declare all purchased items, including their value in U.S. dollars.

3. Provide Receipts: Keep receipts handy to facilitate the declaration process.

4. Duty-Free Exemptions: There are duty-free exemptions depending on the countries visited (e.g., $200 for some countries, $800 for others).

5. Pay Duties: If the value of your purchases exceeds the duty-free exemption, you may need to pay duties on the excess.

6. Mobile Passport Control (MPC): If you have the CBP Mobile Passport app, you can submit your passport and customs declaration information via the app, which can speed up the process.

7. Global Entry: If you're a Global Entry member, you can use the Global Entry kiosks to complete your declaration and enter the U.S.

8. Automated Passport Control (APC): You can also use APC kiosks to complete your declaration.

9. Preclearance: If you're flying from a preclearance airport, you may clear customs before you fly.

10. Be Prepared for Inspection: Be prepared for a CBP officer to inspect your belongings and ask questions.

11. Consult the CBP Website: For more information, log onto the U.S. Customs and Border Protection Information Center website, help.cbp.gov, which has answers to 500 frequently asked questions.

If you are returning to the US with your cameras (or photo gear such as lenses) that were purchased in the US, you could be asked to provide proof they were not purchased while you were abroad. It is always a good idea to travel with copies of receipts (on paper or on your phone) to dispel any suspicion from a CBP officer that you are hiding something that is dutiable. This kind of question may be rare, but it is worth being prepared.

Interacting with your Customs and Border Patrol agent:

Since it’s the CBP agent that reviews your Customs Declaration, interviews you, and inspects your luggage who determines any extra duties to be paid on any new or used Leica gear you’ve acquired overseas, it makes sense to be polite, pleasant, and above all honest in all your verbal statements, explanations, and declarations. It’s perfectly OK to explain, for example, that the Leica was purchased used, or to ask whether a camera purchased new overseas now qualifies as used since you shot with it extensively on vacation. But attitude is everything, and don’t ever come across as defensive, argumentative, or demanding. In many cases any “extra tariff” you must pay may be less than you expected, but even if it isn’t, forking over the cash is a far better alternative than running afoul of the customs authorities. Don’t ask me how I know…

__________________

Disclaimer: This article is based on the opinions, observations, and ad hoc research conducted by the author, and discusses a highly complex, constantly changing subject. Please therefore do not rely upon this as constituting legal or any other kind of advice.